In the name of Allah, The Most Gracious, The Most Merciful.

Assalamualaikum to all,

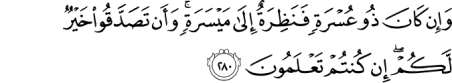

If Islamic banks cannot be an ease to the ummah, there’s no reason for its existence. If charging compounding interest is considered zalim (discriminatory), the act of filing a default for bankruptcy without helping the borrowers can be considered as zalim too. In Surah Al Baqarah verse 280, Allah swt reminded the lenders to give more time to borrowers who are having difficult times to make payments and even remit the loans as sadaqah (charity).

Surah Al Baqarah, verse 280:

Another aspect of Islamic banking that I would like to comment is the Syariah council (Islamic scholars hired by banks to oversee the compliance of financial products according to the Islamic law). In my humble opinion syariah council should not be paid by the bankers. I see this as a conflict of interest. I’m not implying that syariah councils hired by banks cannot be trusted. They are very knowledgable people in Syariah. But humans are humans. They should be hired by the regulators aka Bank Negara (the Central Bank) or become a free governing body. Any application for Islamic banking license or product must go through them. This will keep the system clean from fitnah and any wrong doings in the future, at the same time maintaining consistent practices.

In the future, I am praying that there will be Syariah councils which consists of people who are experts in both field of mathematical finance/banking and Syariah. Some colleges which are offering the Islamic banking/finance courses hopefully are having this in mind. Such council with two fields in mind can orchestrate the creation of new banking products and risk management system which would not be the “immitation” or mirror of the conventional banking system.

I am not against the Islamic banking system. I love that Islamic banking is free from speculating activities. Conventional banking system has become a paper money casino, which contribute to the instability of the current financial system. There are rooms for the Islamic banking system to improve.

In the end we must all know that this system is standing on a system that I considered non-Islamic – the fractional reserve banking system and paper money system. I do not know if Islamic banks can survive in a 100% reserve banking system (how much deposit you have is how much you lend). In the Quran, money is dinar & dirham. Gold & silver must be mined and cannot be manipulated like paper money (can be manipulated by debasing them, but in the past anyone who tried to debase them get a very serious penalty). Paper money is the mother of inflation. More and more money circulating in the economy means inflation. It erodes purchasing power. So in order to retain its purchasing power, savings must be given interest rates/profit returns. If not, money sitting in the banking system will lose its value as prices of goods & services rise due to inflation. Normally, no one would want to save. But in this era of low rates, people are not looking at rates anymore but putting money in a bank has become about convenience rather than seeking investment income. But until the faltering modern financial system goes, we have to operate within the system.

I am still learning and my opinions are solely mine. Allah swt knows best and may He show us the straight path. Please feel free to drop your comments below.

Jazakallah khair (May Allah grant you goodness).

Fadzli Fuzi

Leave a comment